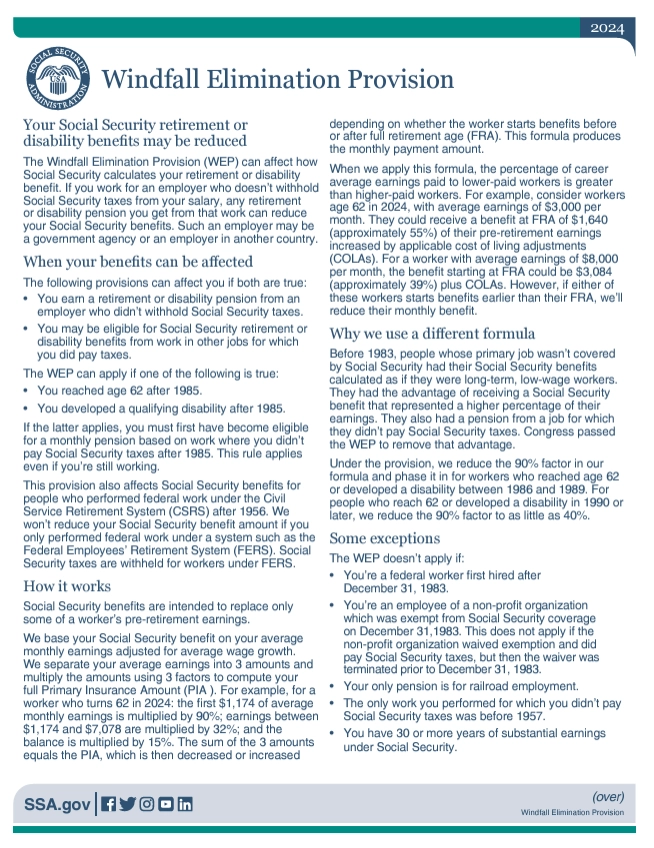

In most cases, employees of the State of Louisiana who are members of LASERS are not required to pay Social Security tax. However, if you are entitled to a Social Security benefit, either your own from private sector employment or a spouse’s or widow/widower’s benefit, that benefit may be reduced because of the Windfall Elimination Provision (WEP) or the Government Pension Offset (GPO).

Your LASERS benefit will NOT be reduced, but you should be prepared for a reduction in your Social Security benefits.

The LASERS Board of Trustees considers the reduction or elimination of the WEP and GPO as a significant Board issue. However, any change to these offsets must be made on the federal level. LASERS continues to track federal and state legislation regarding changes to the WEP and GPO and will keep members informed as changes occur. RSEA also monitors legislation and is committed to the elimination of the offsets.